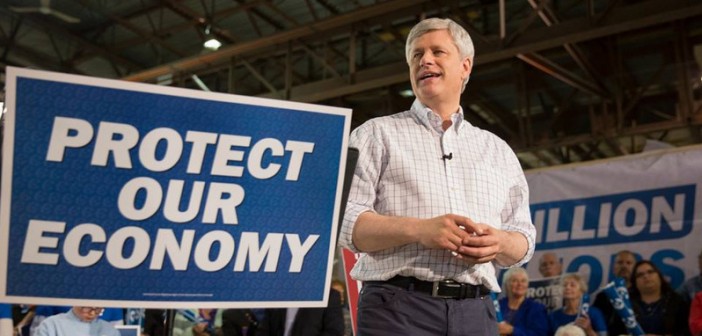

How the Conservatives ravaged Canada’s economy can be gauge by the yawning deficit earlier politically advertised as a balanced budget. The Harper Conservatives ransacked Employment Insurance (EI) to cover a deficit and sold GM shares at a loss. It is an asset that will never be recovered.

A series of biased policy direction in favor of big oil and dirty tar sands rendered Canada’s manufacturing sector helpless. Agriculture, which represents about one third of the economy, was about to be handed in a silver platter to a Trans Pacific Partnership that aims to unshackle internal protection systems that balances domestic demand and production. All of these were done by the previous government in utter secrecy.

An economic report by the Bank of Nova Scotia, obtained by MetroVan Independent News, showed that all key economic indicators are falling. The bank predicted that while the loonie reached an 11-year low of C$0.74 cents to a US dollar, it can still go down to C$0.71 cents in about two months. But the real fear is that it can go to uncharted territory — meaning it can even slip much lower than anticipated. This will wreak havoc on prices as everything becomes expensive. It can also spawn uncontrolled inflation.

Canada’s speech from the throne warned of “challenging economic times.” New recent records for our currency and commodities plus two sets of data out last week — jobs and trade — are warning of a shakeup that could even be bigger than projected. The Canadian dollar falls to its lowest level since 2004 as oil prices slips again. The country sheds 35,700 jobs in November, unemployment rate up to 7.1%. In contrast, solid U.S. job gains will likely cause the US to hike interest rates which will exert a dampening effect on the loonie. The US unemployment rate is now down to 5 percent or at a level just about at a threshold where they don’t need to import workers.

Bank of Canada governor Stephen Poloz is obviously paying attention. In his Canadian Monetary Policy Report, Poloz actually made divergence in interest rates the watch word. “Policy divergence is expected to remain a prominent theme,” he said.

Since the US is Canada’s biggest economic partner, the interest rate move can have an effect on our domestic market since US interest cost can weave itself into the price structures of imported goods from that country.

There are a lot of economic policy consideration that Trudeau’s new government needs to address. We are predicting that the adverse effect on the economy brought about by — wild-eyed Conservative ideologues from Alberta –will take more than two years for this new government to unravel and correct, and only if global economic conditions become favorable. Otherwise, we will fall into hard times. (YB)